Where do the Staking Rewards come from?

Many ADA users understand the Staking Rewards as a fixed percentage. This is understandable, because everyone can visualize it directly.

Technically speaking, however, the rewards do not represent interest and should not actually be expressed as a percentage. To understand this, you need to take a look at how Cardano is financed and how the rewards are created. We will try to make this highly complex matter as simple and easy to understand as possible, but first we need to explain a few terms.

What is the Treasury?

The treasury is a decentralized pot/fund that is replenished a little with every transaction made. So far so good. But there are various ways to finance a cryptocurrency and its further development:

- Donations: A popular form of financing is voluntary donations from users via a non-profit organization such as foundations. The development and maintenance of the system is often undertaken on a voluntary basis.

- ICO: Another system is the Initial Coin Offering (ICO). By selling your own generated coins, it is possible to raise a lot of capital right at the start of a project.

However, both systems are not designed to be sustainable. As soon as there is a lack of voluntary support or the capital from the ICO is used up, development often comes to a standstill.

Cardano therefore uses a self-financing treasury system.

Brief info: The ADAs stored in the treasury will be used in the future, for example, to provide financial support for Cardano projects via voting procedures - but back to the topic.

Where does the money for the treasury come from?

- Taxation: Each individual transaction tops up the treasury with a percentage from the block premium.

- Donations: Not sustainable, but still another contribution

- "Minting" (it is also possible to "mint" a certain number of coins with each block, but this is not currently planned)

Now that we know the origin and purpose of the Treasury, let's move on to the rewards.

How are the rewards calculated?

The amount of the rewards can fluctuate, as they depend on various factors such as participation, transactions and the financial reserve set up specifically for this purpose.

What is the reserve?

The reserve consists of ADA that has not yet been generated and amounts to ADA 14 billion (as at the beginning of 2020).

What is a slot leader?

A Cardano epoch currently consists of 432000 slots (5 days). In each slot, one or more nodes that produce blocks (usually stake pools) are nominated as "slot leaders". On average, a node is nominated every 20 seconds, resulting in a total of 21600 nominations per epoch. When randomly selected slot leaders produce blocks, one of them is added to the blockchain. The blocks of the other candidates are discarded.

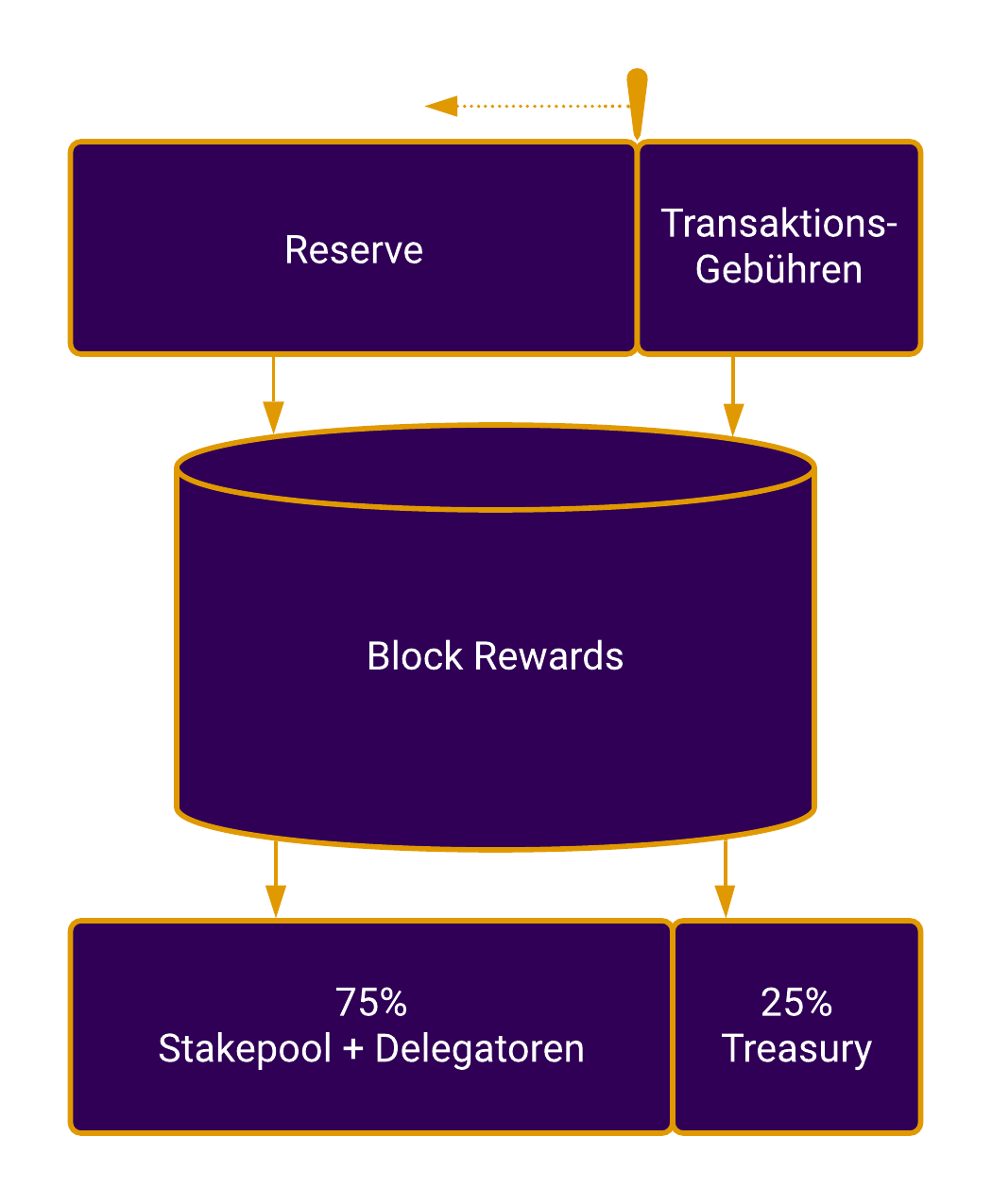

How are the rewards created?

In each epoch (5 days), a rewards pot is filled according to various rules of the protocol. At the end of the epoch, this is paid out to the respective randomly selected slot leader (this is one of the nominated staking pools that has successfully verified blocks) and the protocol distributes the rewards proportionally to the amount of your stake (share) among all delegators in the pool. The pot of the next epoch is filled with slightly different values and the amount of the rewards therefore always fluctuates slightly.

How exactly does the "stake pot" fill up?

The rewards are calculated (over the years) from two opposing curves:

1. the reserve (14 billion ADA, see above), from which 5% is withdrawn every year - this can never be completely empty, but the amounts are constantly decreasing due to the withdrawals.

2. the transaction fees and the "taxes" that the pool operators pay for each block. It is assumed that with increasing distribution and use of Cardano, revenues and taxes will increase, thereby offsetting the fall in the first curve.

How are the "taxes" of the pools calculated?

When a Cardano owner sends ADA coins or makes other transactions, they pay approximately 0.17 ADA (as of March 2021) in fees. The pool that is currently the slot leader and is allowed to confirm this block with this transaction receives a bonus with fresh, not yet generated ADA, taken from the reserve - for example 1000 ADA.

Then he adds all transaction costs (e.g. for 100 TX) to his bonus:

1000 + (100 * 0.17) ADA = 1017 ADA - this is the complete block reward.

Now the slot leader receives 2 addresses - one is the predefined address of the Cardano treasury and the other is any address (usually his own). He sends 75% to himself and 25% "taxes" to the Treasury.

The Treasury therefore receives 1017 x 25% = 254.25 ADA - and the pool receives 762.75 ADA, which is paid out to the delegators (depending on their stake) after deduction of the pool fees.

When other nodes receive this block, check whether the correct share is sent to the treasury. If everything is OK, they add the block to their blockchains. If they receive a block where the 25% tax is NOT paid to the treasury address, they notice this and discard the block as "invalid". All this happens every 20 seconds.

We hope we have been able to help you with this article and shed some light on how Cardano rewards are generated!

If you have any questions, write to us or get in touch via our social media channels!

Stakepool Germany in cooperation with the Quest Pool